Regional competitiveness is above the EU average in all regions in Austria, Benelux, Germany and the Nordic member states. In contrast, most regions in eastern Europe score below the EU average

The eastern Romanian city of Galati

Romania and Bulgaria rank bottom and second bottom respectively in terms of innovation in the newly updated version of the EU’s Regional Competitiveness Index (RCI) published on Monday.

Between them, they are home to eight of the top 10 least competitive regions in the EU. At the bottom are the Sud-Est and Nord-Est regions in Romania and the Severozapaden region in Bulgaria, which have all become less competitive since the previous RCI based on data from 2019.

Regional competitiveness is defined as the ability of a region to offer an attractive and sustainable environment for companies and residents to live and work.

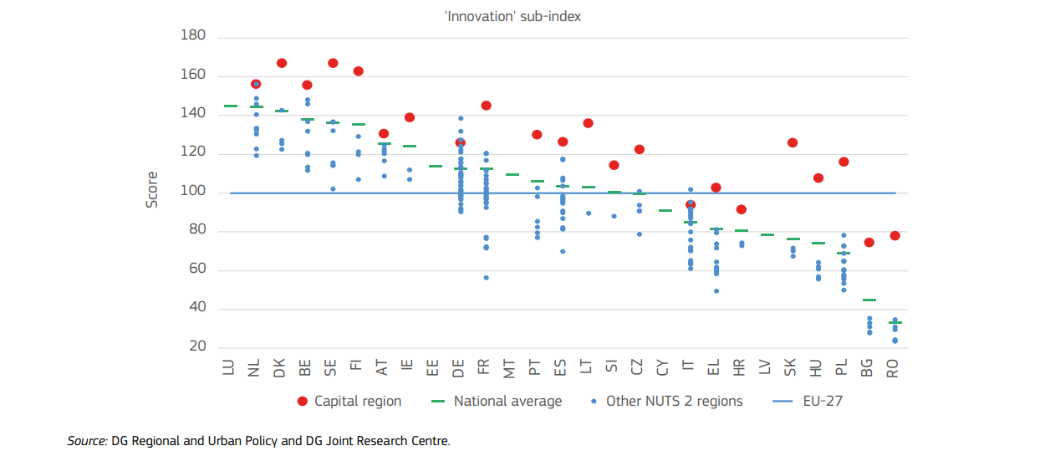

The RCI has been published every three years since 2010, with this latest version being branded ‘Index 2.0’ to reflect modifications in the methodology. It classifies countries based on three sub-indexes named basic, efficiency and innovation. Romania is last in all three, while Bulgaria is second last in the basic and innovation categories.

Basic refers to the key basic drivers of all types of economies, including the strength of institutions, macroeconomic stability, infrastructures, health and basic education.

The efficiency sub-index includes higher education, training and lifelong learning, labour market efficiency and market size. As a regional economy develops, these aspects are related to a more skilled labour force and a more efficient labour market.

The innovation index covers technological readiness, business sophistication and innovative capacity.

The publication of the new index, based on 2022 data, comes as the EU scrambles to reinforce policies supporting research and innovation in laggard regions. EU research Commissioner Mariya Gabriel on Tuesday announced a call for regions to sign up to a new initiative called regional innovation valleys (RIVs), which is meant to build on previously announced initiatives such as the Smart Specialisation strategy and the partnerships for regional innovation (PRI).

Not catching up

One of the key findings of the RCI is that all eastern regions, with the exception of most capital cities, are below the EU average in competitiveness. What’s worse, so-called “catching-up” regions in Czechia, Slovakia, Romania and parts of Bulgaria, are actually moving further away from the EU average and getting less competitive.

Looking specifically at the innovation sub-category, only Estonia, Lithuania and Slovenia score about the EU average, with Czechia falling just below.

Emil Boc, chair of the Commission for Territorial Cohesion Policy and mayor of Romanian city Cluj-Napoca, stressed the importance of regional competitiveness at the launch of the index on Monday.

“Despite the differences, there is one thing that unites all regions in the EU, and that is the need to remain competitive in a rapidly changing global economy,” he said. “We cannot have a competitive Europe without competitive regions and cities.”

The report highlights several benefits of a region being competitive, including the fact that the GDP per capita is higher, higher achievement rates for women and recent graduates being able to find work faster.

“More competitive countries tend to have a smaller gap between their capital city region and its other regions,” the report says. “They also have smaller differences between all their regions. This shows that the performance of all regions matters for a country’s competitiveness.”

EU funds drive improvements

While the list of the top ten most competitive regions is dominated by north European countries, there are some positives for the Widening countries in central and eastern Europe, so called because they have less well developed research systems and infrastructure.

The capital region of Lithuania improved its competitiveness by 18 index points, the region of Norte in Portugal improved by 14 points, the capital region in Poland by 12 points and the region of Śląskie (Silesia) in Poland by 10.

Jakub Chełstowski, marshal of the Śląskie Voivodeship (province) and member of the European Committee of the Regions, said at the index launch that European funds are a significant factor behind the improvement in the region, which is transitioning its industry away from mining towards modern, clean tech industry.

Elsewhere, catching-up regions in Baltic countries, Croatia, Hungary, Slovenia and Poland continued to get closer to the EU average.

Big picture data

Using composite indicators to measure a region’s competitiveness is not an exact science, a factor highlighted by Henri de Groot, professor of Regional Economic Dynamics at the VU University Amsterdam, speaking at the launch.

He called for the RCI to create a clearer picture of how the sub-indicators it measures work together, where they are complementary, or where there are trade offs.

For example, in the Netherlands, which has very strong institutions, this can have disadvantages of that are not necessarily captured in the index. “These strong institutions can at some point in time also result in a huge accumulation of vested interest and a slowing down of progress,” de Groot said.

He also questioned the lack of sustainability measurements in the index, saying the impact of future environmental issues should be taken into account, as well as including measurements of social capital.

Eleni Papadimitriou, scientific officer at the European Commission’s Joint Research Centre, came to the defence of the index, saying it is a “powerful tool to synthesise big picture data.”

“This helps our policymakers summarise […] complex information,” she said. Ranking regions forces governments and institutions to acknowledge where they stand.

Innovation Valleys

The publication of the RCI on Monday kicked off a week of events in Brussels linked to regional innovation policies.

On Tuesday, EU research commissioner Mariya Gabriel announced a public call for EU regions to participate in the regional innovation valleys (RIV) initiative, which aims to foster interregional and cross-border collaborations to boost local innovation ecosystems.

The Commission is hoping to get 100 regions to sign up to the initiative. By way of incentive, it is putting out two calls in May worth a total of €170 million to support innovation activities within newly created valleys. The money will come from both Horizon Europe and the European Regional Development Fund, making it the first time these two funding mechanisms have been used in combination to support interregional innovation.

The announcement of these calls came during an event centred around another initiative focused on regional innovation, called Partnerships for Regional Innovation (PRI).

This initiative was launched in May 2022, and 74 territories around the EU signed up for a one year pilot. A playbook for how these partnerships should go about boosting their innovation ecosystems was created and the pilot is intended to help fine-tune that guidance.

At the event on Tuesday it was announced that the pilots would be extended beyond the one year, with no new deadline given.

In terms of how the new regional innovation valleys link to the PRI initiative, a spokesman from the Committee of the Regions told Science|Business the idea is that the RIVs will build on experience gained through the PRI pilot. Not all territories involved in the PRI initiative will necessarily form “innovation valleys”.

The EU’s regional innovation policy strategy gets more complicated when the Smart Specialisation initiative is added to the mix. This is where EU regions set out priority innovation areas and then try to collaborate with other regions with similar priorities. Over 180 national and regional Smart Specialisation strategies have so far been created and those are expected to feed into the RIV initiative, although it is not clear at this stage how.

On top of that, the European Institute of Innovation and Technology has its own regional innovation scheme targeted at countries with moderate or modest innovation scores based on the European Innovation Scoreboard. This scheme is also supposed to connect to the Smart Specialisation strategies, meaning there are four inter-connected but separate EU initiatives aiming to boost regional innovation ecosystems.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.