The Commission will not introduce trade measures against Chinese solar panels. Instead, commissioners urge EU member states to subsidise domestic manufacturing

EU energy commissioner Kadri Simson. Photo: Tofik Babayev / European Union

Science|Business - Table.Media partnershipScience|Business has partnered with Table.Media, a leading source of news about higher education and research in Germany. Each week, we are publishing one of each other’s stories to give readers an even broader range of insight into R&D policy across Europe. |

Kadri Simson seemed almost to be pleading on Monday. "We cannot close our borders because we need solar panels," said the EU energy commissioner ahead of a meeting of energy ministers in Brussels. "We have to support our industry, but we need all the products to meet our very ambitious targets."

In other words, the EU needs Chinese solar products so urgently to expand its renewable energy capacity that it must leave the doors open to imports.

These words dashed the hopes of some European manufacturers that the Commission would protect them from Chinese dumping of solar modules (arrays of panels). Simson and industry commissioner Thierry Breton's letter to the Council presidency last Thursday carried the same message.

That letter lists five pages of measures on how to support the European solar industry. However, trade restrictions are not even mentioned. According to Breton and Simson, there will be no further discussions until the second half of the year. In other words, not with the current EU Commission.

Instead, Simson and Breton are passing the ball back to the member states – but also to those solar companies that have been campaigning against import restrictions on cheap modules. At the start of the week, Enpal, 1Komma5, EnBW and Vattenfall, among others, unveiled the new Solar Economy Europe (SEE) alliance.

Commission backs Germany’s plans

Simson and Breton want to encourage distributors to take responsibility voluntarily: wholesalers and distributors could commit to including a range of EU-made PV products in their portfolio. Industry sources say a corresponding declaration with voluntary commitments could be signed at one of the next Council meetings in May.

However, the letter is also aimed at the member states, with Simson and Breton recommending they introduce "ambitious sustainability and resilience criteria" in solar system auctions. The Commission thus backs German economy minister Robert Habeck – from the Green Party - who would like to introduce a solar package with ‘resilience bonuses’ to pay more for electricity from European-manufactured solar modules. But the German Free Democratic Party, part of the governing coalition alongside the Greens, rejects this over cost concerns.

Solar industry permanently dependent on subsidies

However, in the long term, Solar Power Europe president Aristotelis Chantavas demands that the aid framework also allow subsidies to cover manufacturers' operating costs. It can be seen as an admission that domestic production will never be cheaper than the Chinese competition.

"China is pursuing a very aggressive industrial policy and sector strategy. China spends almost three to four times more on industry support and subsidies than we do in the west," says Johan Lindahl, secretary general of the European Solar Manufacturing Council (ESMC). The industry association represents the interests of the European PV manufacturing industry, with its most prominent members including manufacturers like Meyer Burger and Wackers.

The US-based Center for Strategic and International Studies (CSIS) estimates that China spent 1.7% of its GDP on industrial support and subsidies in 2019. According to the report Red Ink: Estimating Chinese Industrial Policy Spending in Comparative Perspective, France only spent 0.5% and Germany 0.4%. China's industrial strategy focuses even more strongly on strategic sectors such as photovoltaics, batteries and electric cars.

Furthermore, the US is giving large tax rebates to manufacturers planning to build solar power production projects as part of the Inflation Reduction Act. Washington has also introduced import tariffs on Chinese solar modules.

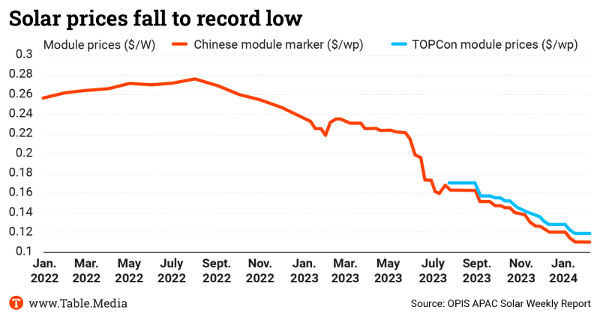

India also works with subsidies, but to a lesser extent than China, as Lindahl explains. These and other developments have made the European market the most attractive for Chinese manufacturers. "This is why there is such a huge oversupply of modules flowing into Europe. This has led to a drop in prices and a very difficult situation for European module manufacturers," Lindahl said.

Lindahl says that his organisation has not campaigned for tariffs on Chinese modules. This is because a possible anti-duping investigation would take one to two years. By the time the investigation is completed, the EU sector will have disappeared.

Emergency measures

ESMC has instead advocated emergency measures limited to the next two years. They would apply until the EU legal framework is improved – through legislative packages such as the Net-Zero Industry Act or the ban on goods produced by forced labour.

This could establish a system at the EU level where European-produced modules could be sold at market prices, Lindahl said. "And then either the EU or the member states would cover the difference between the market price and the current production costs."

The association estimates that around €880 million will be required by 2025 to keep the European sector operating at 40% capacity, to cover personnel costs in 2025 and 2026. In return, such a step would prevent the outflow of €560 million from the European economic area and thus reduce the trade imbalance with China, Lindahl said.

This text appeared for the first time in Research.Table, a professional briefing from the largest independent start-up for quality journalism in Germany. The editorial team reports for the key people in the research scene who set and fill the framework for science, research and development.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.