US and EU need to build up key advanced industries as China’s global market share surges, Washington, DC, think tank report finds

Robert D. Atkinson, “The Hamilton Index: assessing National Performance in the Competition for Advanced Industries” (ITIF, June 2022).

The US and EU have fallen behind over the past 24 years in several of the advanced industries that are central to their economic and national security, while China has taken a bigger global market share, according to a new economic index released on Wednesday.

Both the US and EU need to invest more to innovate in their semiconductor, computer, and electronics industries, each of which China has funded heavily and grown its market share quickly, according to the study by the Information Technology and Innovation Foundation (ITIF), a Washington DC innovation and policy think tank.

The ITIF report recommends that US and EU policymakers work to bring key advanced industries onshore rather than relying so heavily on production by other nations.

The report comes as policymakers on both sides of the Atlantic debate how to pump up flagging industries. It warns the US and EU should be worried as they lose share to China. The US ranked second to the EU in 2018 in global market share overall in advanced industries, and it is likely that China has surpassed both the EU and US by now.

“China is a major threat to the competitiveness of Europe and the US,” said Robert Atkinson, ITIF president and the author of the study. “Policymakers can’t rest on their laurels.”

The ITIF report is just one of several recent international competitiveness studies to warn of shifting global market share and investment, with China expected to continue making headway.

The OECD Science and Technology Indicators report issued in March found that most economies in its area increased their R&D intensity, measured as R&D expenditure as a percentage of GDP, in 2020.

The US still led in R&D intensity in 2020, with R&D expenditures making up 3.5% of its GDP, up from 2.7% in 2010. But over the past 10 years, China at 2.4% has nudged ahead of the EU at 2.2%.

The European Innovation Scorecard 2021 confirmed China is on the rise, with its innovation performance from 2014 to 2021 increasing the most at 27.9%, while the US rose 16%. Both increased at a higher rate than the EU at 12.5%.

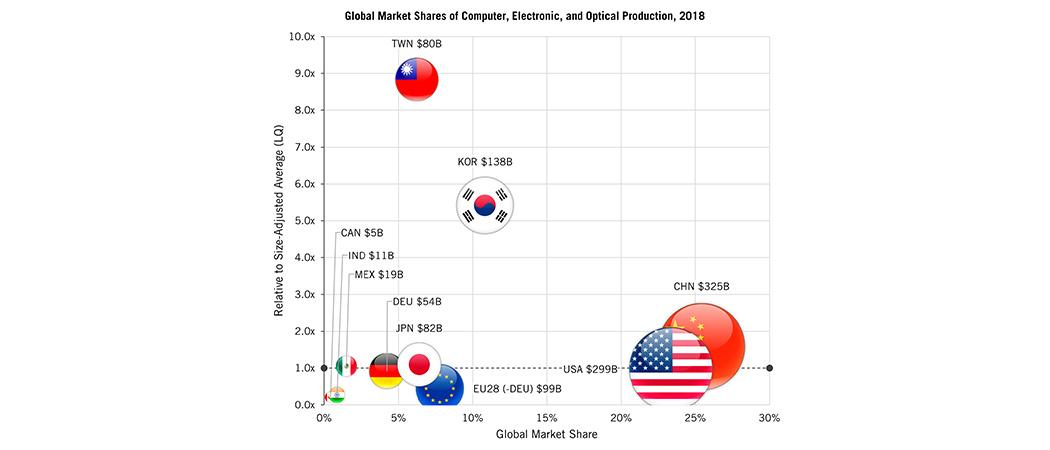

China has seen fast growth, from 4% of global output in advanced industries in 1995 to 21.5% in 2018, the most recent year for which OECD data is available. Its strongest growth was in electrical equipment, where it controls more than 33% of global production.

During the same time period, the EU’s market share slid from 29% of global output in 1995, to 23% in 2018 and the US declined slightly from 24% to 22.5%. Japan, which had been a leading innovator with its strong consumer electronics and semiconductor companies, saw its share of global production fall by two-thirds from 25% of global output to 8%.

Regaining share will be a challenge

“If policymakers wanted US advanced industries to constitute the same share of the US economy as they do in China, then US output would have to expand by 42%, or $679 billion annually – 3.3% of the GDP,” the report said.

The ITIF report assessed national performance by examining the share of global output by country from 1995 to 2018. It used data from the OECD for 66 nations that account for most of the world’s output, not adjusted for inflation. It looked at performance individually by industry and by aggregating industries in its own “Hamilton index.”

The report focuses on 10 countries, assessing their performance in seven advanced industries important to economic and national security. The computer, electronic, and optical products group is the most watched of those industries because it includes semiconductors and virtual reality systems. China led the world in that industrial segment with 25% of production in 2018, while the US fell to second place with 23% of market share.

The report recommended that the US put a national advanced industry strategy into place. That would include the CHIPS for America Act to boost the semiconductor industry. The EU is considering a similar plan, the European Chips Act. Both acts are not near being passed and fully funded in either country. The US Senate has passed the act, but the US Congress is trying to hammer out a compromise version.

With China’s power rising, Atkinson said there is more of a possibility for cross-border, government-supported technology collaboration to strengthen both geographies.

“Hopefully, EU officials will understand this reality and dampen some of their anti-US rhetoric around their calls for ‘digital sovereignty,’” he said. “China is their real techno-economic challenger, not the US.”

Meantime, US policymakers need to think big.

“Congress and the administration should set an ambitious national ‘moon shot’ goal of increasing the relative concentration of advanced industries in the US economy by 20 percentage points in a decade,” the report said.

Meeting that goal could add about $2.5 trillion to the US advanced industry output over 10 years if the rest of the economy grows 3 percent. The government also needs to put incentives in place to induce companies to invest more in the US.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.