Autonomous vehicles, 6G mobile and an expansion of the Innovative Medicines Initiative to take in medical devices, diagnostics, vaccines and biopharmaceuticals are on the list of public-private partnerships. Six existing partnerships march on, with fresh objectives

Image: Akarat Phasura, Bigstock

The European Commission has suggested major new industrial research partnerships on driverless cars and the 6G mobile internet and said it wants to expand the scope of the Innovative Medicines Initiative to cover healthcare technology more broadly, while launching a new EU partnership for healthcare in Africa.

The proposals are part of a recently-circulated list of suggestions put forward for consideration by member states, as part of the planning process for Horizon Europe, the EU’s next research programme.

Industrial partnerships are a major area of EU research spending, and among the largest are eight joint undertakings. The new list of 11 includes obvious replacements for all eight – though with major changes to two of them – plus three new ones in self-driving cars, mobile data networks, and health in Africa.

Alongside the list is a collection of files giving details of each potential partnership. The suggestions are preliminary and could change substantially before being drafted as legislation. None of them include budget proposals.

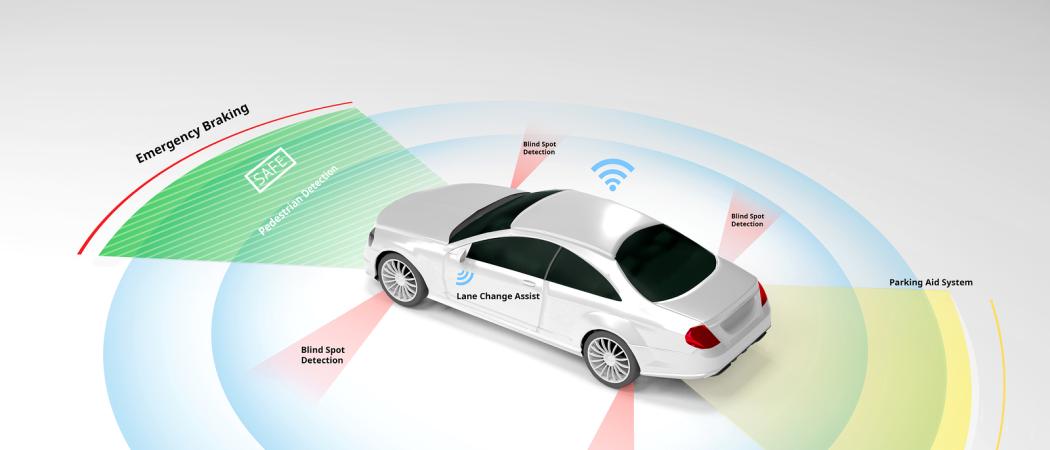

Self-driving cars

The MOSART (Mobility and Safety through Automated Road Transport) partnership on self-driving cars will aim to pull together disparate research projects to address problems caused by fragmentation and to ensure interoperability. The current lack of coordination risks undermining EU competitiveness in the development of autonomous vehicles and its ability to lead the development of global standards, the commission says.

Alongside the EU and member states, MOSART could include car manufacturers and suppliers, public and private transport operators, mapping and satnav services, artificial intelligence and telecoms companies, and others.

The memo says MOSART could cooperate with proposed partnerships in air traffic management and railways (roles currently filled by SESAR and Shift2Rail) to work on interfaces with other modes of transport, such as aerial drones and light rail, which often use the road network.

5G and 6G wireless networks

While 5G wireless networks not yet a reality in Europe, the commission is already thinking about 6G, in a partnership on “Smart Networks and Services.” There is a target date of early 2020 for 5G deployment to begin, and this partnership, which is due to run until 2030, will in effect cover 5G and 6G.

The primary aim will be “to develop and deploy technologies that will define beyond 5G and later 6G networks and services,” with a focus developing applications that will allow consumers and industry to extract the full benefits from mobile networks that will reach speeds of up to a terabit per second.

The new partnership will build on an existing public-private partnership, Advanced 5G networks for Future Internet, which involves Nokia, Ericsson, Orange, Thales, Huawei, Telenor, and Telecom Italia, amongst others.

Pharmaceuticals partnership expands into healthcare

The commission suggests the Innovative Medicines Initiative (IMI) should expand its scope to become the Innovative Health Initiative (IHI), broadening the remit from pharmaceuticals to include diagnostics, medical devices, medical imaging and biotech. That would impact not only the research agenda, which currently is decided by the research directors of pharmaceutical companies, but also its composition, since the industry partners’ contribution to IMI is managed by EFPIA (European Federation of Pharmaceutical Industries and Associations).

IMI was set up in Framework programme 7, investing €2 billion from 2008 – 2013 in research aiming to plug the gaps in Europe’s system for translating bioscience research into new therapies. The partnership was renewed in Horizon 2020 and is due to invest €3.28 billion up to 2024. Of this, €1.64 billion comes from the Horizon 2020 budget in grants for academics and small companies. Pharmaceutical companies are putting in €1.425 billion, in the form of ‘in kind’ contributions of staff and resources, for individual projects. The last calls will be in 2020, making way for a new partnership in 2021.

While the partnership is between the EU and EFPIA, IMI also has an assortment of associated partners including charities, universities, research institutes and small companies.

Expanding IMI’s scope would therefore mean more than just rewriting its research agenda. In addition to EFPIA, the commission highlights five other industry associations as potential partners:

- MedTech Europe, representing medical technology companies

- The European Coordination Committee of the Radiological, Electromedical and Healthcare IT Industry, which is focussed on medical imaging

- EuropaBio, which represents biotech companies

- European Biopharmaceutical Enterprises

- Vaccines Europe

The commission’s memo notes that companies from the digital sector would also be needed, and that the current system of associating foundations and charities could continue. The document does not speculate on whether the new look IHI would need a larger budget or more EU funding than IMI2.

New health partnership for Africa

While the main emphasis of the proposed EU-Africa Global Health Partnership is on improving health in sub-Saharan Africa, the memo also stresses benefits for European health, and tackling health problems that impact both regions.

For example, both Africa and eastern Europe have elevated rates of HIV/AIDS and tuberculosis. In addition to improving health and tackling infectious diseases, the partnership would also aim to improve scientific knowledge in Africa and Europe.

The partnership would mostly involve national governments in Europe and Africa, but could also include pharmaceutical companies, charities, and non-governmental organisations.

Partnership in fuel cells to expand

The Fuel Cells and Hydrogen (FCH) joint undertaking would be replaced with a Clean Hydrogen partnership, covering the entire hydrogen energy sector, from production to distribution, and consumption.

FCH already covers the production and distribution of hydrogen fuel cells. However, the new partnership would not be quite so focused on fuel cells specifically, and would look at other technologies for safely harnessing hydrogen as an energy source.

The current partnership has a budget of €1.3 billion over 2014-2024, of which the EU pays €665 million. The members are the EU, an industry group and a research group. The industry group consists of the trade association Hydrogen Europe, which includes BMW, ENGIE, EDF, Honda, Michelin, SNCF, and Siemens as members. The research group, Hydrogen Europe Research, is in federation with the industry association and includes Aalto University, EPFL, and TNO.

Other partnerships march on

The other six public-private joint undertakings are slated to be replaced with similar-sounding partnerships, but given new targets to aim for.

None of the names are necessarily final, and there is no reason to assume some of the old names will not be re-used.

The EuroHPC partnership in high performance computing, which began operating in January this year, will continue as it is. The other five are older, with their legal mandates having been established for the start of Horizon 2020 in 2014.

Electronic Components and Systems for European Leadership will be replaced by Key Digital Technologies, a partnership with a similar remit of supporting European competitiveness in microelectronics, but with added emphasis on cybersecurity and technologies such as artificial intelligence.

Bio-Based Industries will be succeeded by a partnership, “for a circular bio-based Europe” with a brief to deliver, “sustainable innovation for new local value from waste and biomass.” The memo suggests the new-look partnership may involve a larger number of stakeholders.

Single European Sky ATM Research (SESAR) will be replaced by a partnership for Integrated Air Traffic Management. SESAR, currently in its second incarnation, is already heavily focused on integrating air traffic management (ATM) across Europe, in addition to introducing new technologies. However, the memo says, “the effective and harmonised modernisation of the ATM network has not yet occurred,” and the new partnership will pick up where SESAR left off.

The railways partnership, Shift2Rail will continue with its work of, “transforming Europe’s rail system,” to make European rail travel more cost-efficient and reliable.

The Clean Sky 2 partnership, to be renamed Clean Aviation, will maintain the focus on de-carbonising the aviation industry. There will be changes to how it is run, with the new partnership having “a strongly improved governance structure, increased capacity for managing projects and a much simplified structure, increasing efficiency and flexibility.”

A ninth joint undertaking, Fusion for Energy (F4E), is not a public-private partnership with industry, but a vehicle for the EU’s contribution to ITER, the international fusion energy project. It is not mentioned in the new list of partnerships, but that does not mean it will not be renewed, given its markedly different character from all others.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.