As the US tries to strangle China’s access to technology, Beijing is reorganising its R&D landscape and incentives in a bid to become more self-reliant. European companies and researchers will need to navigate these shifting priorities

Open the newspaper, and you’ll get the impression that when it comes to innovation, China is soaring. That observation rests in large part on a story of quickly rising numbers.

Year after year, China is generating more scientific papers, filing more patents, and climbing higher in rankings that track global innovation. That such an obsession with quantity is not necessarily yielding quality work is obvious to many, including the leadership of the Chinese Communist Party.

Indeed, a closer look at China’s innovation system reveals that changes are under way – and this could have significant consequences for how Europeans collaborate with the country.

The pressure in China to publish papers, especially in high-ranking journals, has been anchored in evaluation processes and funding for quite some time. Take, for example, the State Key Laboratory of Robotics. It is located in Shenyang, the provincial capital of Liaoning, a part of north eastern China known for its former glory as an industrial centre.

The lab has done well-publicised work, especially in underwater robotics. Its 2012 evaluation ranked the lab “good” but its researchers had not published enough in high impact journals, as captured by the Science Citation Index (SCI), that evaluators were looking for. “Although a paper is not a scientific achievement, it is an important representation of a scientific achievement,” Yu Haibin, the director of the robotics lab was quoted saying.

The lab seemed to have since turned things around. By 2017, when the next review rolled around, the website of the State Key Lab claimed to have released 64 SCI-ranked papers. That year, it received a rating of “outstanding.”

Papers to patents

However, only three years later, in 2020, Beijing's State Council issued new guidance on evaluations of research. SCI-indexed publications no longer matter as much. Instead the state issued policies to incentivise commercialisation.

This is part of a larger shift in Beijing’s priorities. These are fuelled by tech rivalry with the US. For years, China’s government has issued plans to gain a strategic edge in technologies of the future, such as artificial intelligence and quantum computing, believing this would enable it to leapfrog the US.

However, the imposition of American export controls such as those already levied on semiconductor technologies, have now made technological self-reliance the top priority. If Beijing’s objective used to be to overtake the US by unleashing a digital revolution, it now shifted to maintaining domestic economic development by securing access to critical technologies. The US has already indicated it will expand controls to other areas.

In response, Beijing is beginning to cut some of the fat and focus resources to facilitate this repositioning. Starting in 2016, Beijing slowed down approvals of most types of State Key Labs. That year, it also bundled several project-based funding programmes into a new one called the National Key R&D Projects programme. Concurrently, new approvals for certain kinds of national research engineering centres were halted in 2016.

The number of high-tech industrial development zones, a mainstay of Chinese industrial policy, has also stayed steady at 169 for several years. In many cases, official targets to increase numbers were missed because the work to remodel China’s innovation system is taking precedence. This pause is in all likelihood temporary. In some cases, new approvals have already started and there are signals that these numbers will start rising in other areas.

Innovation chain

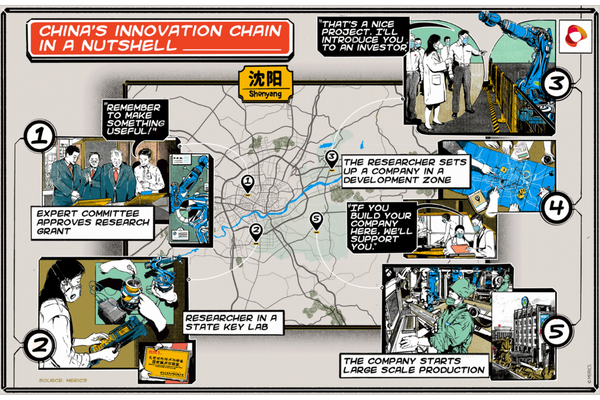

As we detail in a new report released earlier this month, to help boost technological self-reliance, China’s leadership has adopted the concept of the “innovation chain,” a hitherto obscure idea more commonly found in the academic literature on business systems. The aim is to nudge scientific discoveries along a path or trajectory toward a commercialisable product by lining up steps that link the beginnings of basic research with commercial ends.

As such it builds on a long tradition of industrial policy, which is also gaining appeal in Europe again. However, no other national government has tasked itself with generating innovation to the degree that Beijing does. After decades of decentralisation and market reforms, Beijing now emphasises “the socialist system’s unique ability to concentrate resources”. An “all-of-state” effort is needed, China’s top leaders say, to break foreign reliance, lest the US cuts off China’s development path. The notion of the innovation chain enables Beijing to gain control over this inherently uncertain process, optimise it around strategic priorities, and steer the country towards science and technology superpower status.

“We must move faster toward self-reliance in science and technology to relieve the stranglehold of some countries,” said President Xi Jinping on 2 February 2023, calling for the mobilisation of nationwide resources and the integration of innovation, industrial, and talent chains.

That is easier said than done. The goal of connecting different links in the innovation chain is largely aspirational and will likely remain so to a large degree. China is notorious for its struggles to commercialise domestic research. However, China is rolling out new programmes and revamping old ones to achieve better results and these efforts are worth following.

As the sheer research output and growing quality shows, China already possesses many qualities of a science and technology superpower. For European researchers, geopolitical tensions aside, China will remain an attractive collaboration partner for the foreseeable future. But they should be aware that with the shift to an “innovation chain”, more and more of China’s R&D system is being dragged into a national effort to achieve technological self-sufficiency.

Jeroen Groenewegen-Lau is head of programme for science, technology, and innovation policy at the Mercator Institute for China Studies in Berlin. Prior to that he worked at China Policy, a Beijing-based research and advisory company.

Michael Laha is a 2021-22 Alexander von Humboldt Foundation German Chancellor fellow based at the Mercator Institute for China Studies in Berlin. Previously, he was a senior programme officer at the Asia Society Center on US-China Relations in New York.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.