Research and innovation commissioner calls for redoubling of efforts in global race for technological leadership

Mariya Gabriel, EU commissioner for research and innovation. Photo: European Commission

EU companies report rising R&D expenditures for the ninth consecutive year, but overall investment growth is significantly slower than competitors in China and the US, according to European Commission’s industrial R&D scoreboard published today.

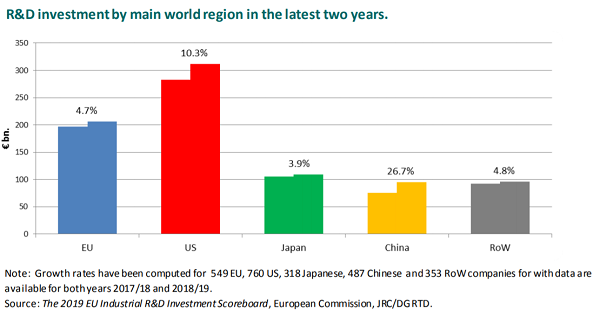

According to the report, in 2018, global industrial R&D investment grew by 8.9 per cent, but most of that growth was driven by companies in China and the US raising their research expenditures by 26.7 and 10.3 per cent respectively. Companies in the EU raised their R&D investments by 4.7 per cent only.

Mariya Gabriel, the new EU commissioner for research and innovation said the EU must “redouble its efforts” if it wants to make the global economy climate neutral by 2050. “Much more [R&D investment] is needed in the global race for technological leadership in deep-tech and sustainability,” Gabriel said.

The scoreboard acknowledges new policy priorities set by the EU in the green economy come with higher corporate responsibility towards the environment and stricter regulations which may slow down growth. But these limitations also come with investment opportunities. “Tackling environmental problems creates market needs requiring new innovative and technological solutions,” the report says.

But sluggish R&D investment by the private sector is not good news in such an uncertain environment.

If European companies are to boost R&D investments in Europe, they need “better framework conditions,” said Alexandre Affre, director for industrial affairs of BusinessEurope, a lobby group representing companies in the EU. “We ask for deeper and faster progress at EU-level in four priority fields: more and smart public investments; fit-for-innovation regulations, skilled people and enhanced collaboration,” Affre said.

The new European Commission has unveiled an ambitious agenda for becoming world leader in green technologies that relies heavily on research and innovation, but is now facing the prospect of a budget lower than it had hoped for 2021-2027, as EU member states failed to agree on what the top priorities are - and how much money they have to spend on them.

Chinese R&D is growing fast

The scoreboard combs through investment data from a league of 2,500 companies around the world that have been investing the most in R&D over the past decade. At the moment, the US has 769 companies in the league, with a cumulative R&D investment of over €313 billion, followed by 551 companies in the EU, with a total of €208 billion in R&D investment, and 507 in China with a total R&D spending of €96 billion.

Over past ten years, Chinese companies increased their R&D investments by a whopping 439 per cent, while R&D expenditure increased by 59 per cent in the EU and 83 per cent in the US. Despite starting from a very low base, Chinese companies have rapidly increased their R&D investments to reach global share of 11.7 per cent.

Since 2009, US companies have doubled their share of global R&D to reach 38 per cent in 2018, with more than 17 per cent of global R&D growth now being driven by the US ICT service sector.

Global industrial R&D is also highly concentrated. The top 50 companies account for nearly 40 per cent of the total R&D investment.

German car maker Volkswagen is the only European company among the top four biggest industrial R&D investors in the world. The top three companies are Alphabet, Samsung Electronics and Microsoft.

According to the report, EU companies have maintained a stable 25 per cent share of global R&D over the past ten years. Car makers contributed the most to R&D growth, reporting a broad patent portfolio on low-carbon vehicles and for self-driving technologies. However, EU companies have lost ground in digital technologies, as US and Chinese ICT companies made substantial R&D investments in this key industry.

The scoreboard also has a separate ranking of Europe’s 1,000 companies with R&D investment of at least €8.6 million. More than 68 per cent of total of industrial R&D investment in the EU is coming from companies based in Germany, UK and France.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.