Phages are viruses that destroy bacteria and have the potential to supplement waning antibiotics. But researchers and entrepreneurs say the regulatory and funding environment is far from clear

Start-ups and scientists are in a race against time to develop new therapies based on phages, tiny bacteria-destroying virus that have the potential to create an alternative to antibiotics.

This week is World Antimicrobial Awareness Week, and the World Health Organisation estimates that growing resistance to antibiotics cost the lives of 1.27 million people in 2019, and the problem is growing. For context, this is more than all confirmed COVID-19 deaths in the US.

Last week, the European Commission released an overview of what member states are doing to combat resistance.

But in the report, there was no mention of phage therapy, a frontier of health R&D that is generating interest from start-ups and some governments. The UK in particular has recently launched several initiatives to help turn phage therapy from an experimental into a mainstream treatment.

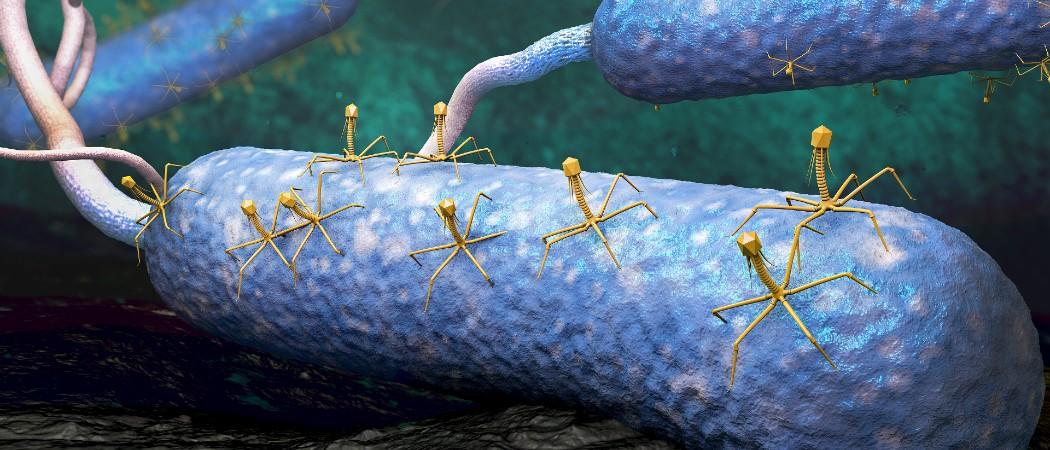

Phages look like spidery aliens – cute or creepy, depending on your point of view - that latch onto bacteria, docking like a spaceship landing on an asteroid, and hijack them to produce phage copies until the bacteria bursts.

They are the most common biological entity on earth, and their bacteria-destroying properties were discovered more than a century ago in 1917. But in most of the world cheaper, easier to administer chemical antibiotics like penicillin were favoured over phages, although in the former Soviet republic of Georgia phage therapy has been studied and used extensively up to the present day.

Despite their history as an obscure chapter of Soviet science, phages are now getting more attention as the antimicrobial resistance crisis grows. One reason is that in contrast to broad-spectrum antibiotics, bacteriophages are highly specific for the bacterial hosts they infect and kill, and the mode of action is unaffected by existing antimicrobial resistance. Bacteriophages in development include products that are designed to be effective against methicillin and vancomycin resistant Staphylococcus aureus, for example.

Last week, MPs on the UK’s Science and Technology Committee decided to launch an inquiry into the potential of phages after hearing pitches from six scientists. “We have been told that whilst phage therapy holds promise, current regulation may be preventing progress,” said committee chair Greg Clark.

Earlier this week, the innovation agency Innovate UK, launched a network to help clear the way for the “general use” of phage therapy across the UK.

The Scottish Health Technologies Group, a body that assesses health technologies for the Scottish government has also conducted an inquiry into phage effectiveness, with the results due imminently.

Lack of data

Currently, phages are most commonly used as a last roll of the dice in severely ill patients where antibiotics have failed. So while there are a number of apparent success stories, these do not add up to the large scale controlled trials needed to put a firm scientific grounding under the technology.

“They’ve been around a long time, but there’s been very, very few, if any, really properly controlled fully powered clinical studies,” said Heather Fairhead, chief executive of Phico Therapeutics, a UK-based company formed in 2000 to develop phage-based antimicrobials. “There’s been ad hoc use on an individual patient basis.”

“That gives us a bit of a credibility problem,” she said. “When you talk to the regulators, there’s no clear pathway for them.”

Regulatory fug

This lack of clarity about how to get phages to market is a problem in the EU too, said Alexandros Pantalis, chief executive of French start-up Phagos, which wants to develop phage treatments for farmed animals (agriculture is one of the biggest current consumers of antibiotics.). In September, Phagos announced it has raised €2.4 million in seed funding.

“There is no precedent in EU regulation for a phage product to be massively distributed in human applications, and in veterinary applications there is one,” he said.

“It’s like a snake biting its tail,” he said. “If there’s no precedent, then it’s not possible to put something on the market. And because it’s not possible to put something on the market, there’s no precedent. We need to break that circle,” said Pantalis.

At the moment, phages are on the whole “shoehorned” into regulatory frameworks that were not designed with them in mind, said Francesca Hodges, who is managing Innovate UK’s new phage network.

There is some hope that phages will soon find their way into the European Pharmacopeia, which defines quality standards for medicines across the EU, both in humans and animals. “If it says, this is the procedure you need to make the phage […] it will make it much simpler,” said Richard James, co-found of Phage UK, another network attempting to mainstream the treatment.

Meanwhile Australian regulation is “ahead of the game”, he said, after clinicians successfully asked regulators for a new set of detailed procedures. “In the UK, we’re going to get left behind if we don’t do something”.

Some entrepreneurs in the UK and EU look longingly over at the US, where the Food and Drug Administration (FDA) is seen as being particularly hospitable towards phage therapy. The lion’s share of phage trials appear to be happening in the US, said James.

The FDA “has been very supportive of our phage approach” said Greg Merril, chief executive of Adaptive Phage Therapeutics (APT), a Bethesda-based phage therapy company that has raised nearly $120 million in funding.

Phages are overseen by the FDA’s biologics group, which also looks after adapting flu or COVID-19 vaccines. There’s an understanding that phages are safe, and pre-clinical studies are generally not needed, said Merril.

Still, the EU does have pockets of phage strength. Horizon 2020 did put some money into phage research, including three European Research Council awards, although there are no Horizon Europe projects underway on phage therapy.

Last year, BioNTech bought up the Austrian phage startup PhagoMed, for example. The Queen Astrid Military Hospital in Brussels is recognised as a leader, producing phage therapy for trials across Europe. The UK, however, lacks its own large scale phage manufacturing facilities, making it “very, very expensive” to run trials, said Hodges.

A Soviet inheritance

It may seem strange that a technology known about and researched for more than a century is such a novelty in western Europe and the US. The mecca of phage science is the Tbilisi, Georgia-based Eliava Institute, founded in 1923, which claims to have the world’s largest collection of phages.

In the 1920s, it developed phage therapies for typhoid and urinary tract infections that were marketed in the west before penicillin eclipsed phages outside the Soviet Union. Work on phages treatments continued, however, despite the execution of the institute’s founder, George Eliava, in Stalin’s terror.

A problem for scientists in Europe is that this Soviet scientific inheritance is seen as largely unusable, in part because the knowledge accumulated in Georgia and elsewhere doesn’t meet modern standards of data rigour yet.

“In eastern Europe, phages have been used for 100 years,” said Pantalis. Phages are available in pharmacies. “These years of experience are currently not usable.”

No incentive to invest

One of the reasons for the antimicrobial resistance crisis is that pharmaceutical companies have largely stopped researching new antibiotics. One report into artificial intelligence-assisted discovery warned last year that R&D had “almost completely ground to a halt.”

Antibiotics one-time use nature makes them much less lucrative than treatments for chronic illnesses. Bacteria evolve, making antibiotics gradually less effective over time. And because of this, hospitals and doctors have tried to clamp down on their use, limiting consumption further.

The risk is that phage therapies suffer from some of the same problems, limiting the appeal to investors.

“They are short courses of treatment so they might not really be thought of as the most attractive [investments],” said Fairhead. As a consequence, “we definitely need that drive and support from governments,” she said.

Governments, charitable funders and cooperations have launched a series of investment vehicles to try to spur the creation of new antibiotics including phages. The AMR Action Fund has put money into APT, while Phico recently won a grant from CARB-X, a collaboration between UK, US and German health bodies. “Without those, it’s really hard,” said Fairhead.

Fundraising has not been easy, Pantalis also acknowledges. Investors wonder why they should pour money into a technology that has already been around for 100 years, but not been widely adopted outside the former Soviet Union.

What’s different now, he argues, is that genomic analysis is vastly easier and cheaper than it was in the Soviet era, allowing researchers to better select and engineer the right phages. “This opens a whole new world of possibilities for phage therapy,” said Pantalis.

Another option is to naturally train phages so that they keep their potency against target bacteria. “I think the benefit of phages over antibiotics is that they can be adapted,” said Hodges.

Going even further, phages can be engineered to avoid bacterial resistance using gene editing. “In my experience talking to pharma companies, they really love the engineered aspect of it,” Fairhead said. It’s also much easier to patent engineered than wild type phages, making investment more attractive, she said.

Merril says that being able to adapt phages, unlike traditional chemical antibiotics, means that the company can offer an “evergreen therapeutic that does not become obsolete” which therefore “presents the potential for investors to achieve a healthy return on investment.”

Advocates for phages stress that they aren’t going to replace normal antibiotics. “Nobody is claiming that phages will solve everything, that's not the case, we just need more antimicrobial options,” said Hodges.

Governments and research funders have long paid little attention to phages because they seemed old-fashioned, lacked compelling trial data, and were considered “too Russian”, said Josh Jones, director of UK Phage Therapy, a non-profit aiming to step up phage manufacturing in the UK.

“We simply didn't need alternative approaches when our antimicrobial needs were being met by antibiotics,” he said. “The AMR crisis has changed that.”

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.