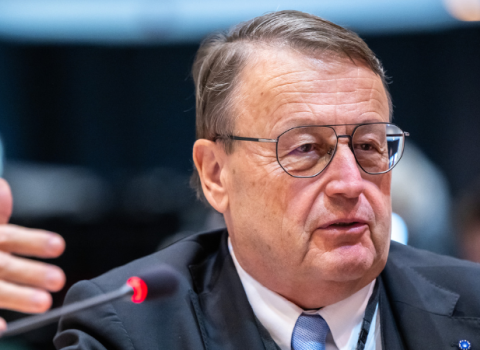

A €350 million cut to the budget of the European Institute of Innovation & Technology (EIT) over a five year period is only manageable if applied sensibly, according to Diego Pavía, chief executive of the EIT’s Knowledge and Innovation Community (KIC) for energy.

The European Commission has proposed the biggest cuts in 2016 and 2017, when the EIT stands to lose €243 million. This makes research agendas “unplannable”, Pavía said. “It risks killing the baby – nobody can adapt to [this size] budget cut.”

The 13 per cent to be cut from EIT’s total budget of €2.7 billion will be diverted into Commission President Jean-Claude Juncker’s investment fund.

“We don’t contest the EU investment package, it’s an extremely good plan,” Pavia said. “What we contest is the curvature of cuts.”

The energy KIC, founded in 2010, is a consortium of over 150 partners who are working translate research through to market and train a cadre of entrepreneurs. It is one of five KICs the EIT has set up, with the others specialising in information technologies, climate change, raw materials and life sciences.

In practical terms, budget cuts will mean sending some EIT students home from the KIC’s two-year master’s course or PhD programme, Pavía said. “These dramatic decisions could be hedged if the cuts were linear,” he claimed. A cut of 15 per cent per annum across six years would achieve the same result the Commission is seeking.

The uncertainty has resulted in KICs indefinitely shelving research calls for 2016. “Could you plan to buy a car if you weren’t sure what your household budget would look like next year?” Pavía asked.

Pavía’s counterpart, Betrand Van Ee, chief of the climate change KIC agreed, saying industry partners buy into the programme looking for predictable investments. "When one partner changes the rules, it has an impact,” he said.

Equity stakes

Unlike the other KICs, Pavía’s energy team is a Dutch-registered commercial company rather than an association. It backs companies with money while requesting a return on investment, and has 27 shareholders.

The energy KIC has taken equity stakes worth between 5 and 19 per cent in 42 start-ups to date, the majority of which it helped create.

While an important step on the road to becoming fully self-financing, which is the ultimate goal of all KICs, these equity stakes are not cash in the bank, said Pavía. “We’re in the energy business, where the lead time to market is on average seven years,” he said.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.