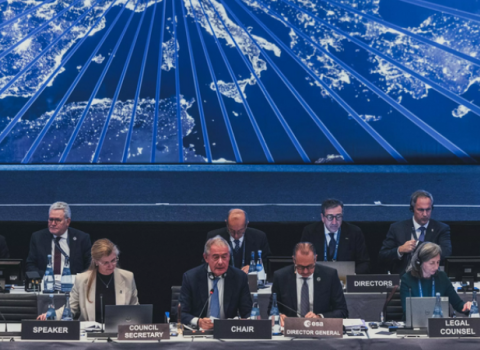

But promising tech start-ups and innovative mid-size companies in Europe are starved for later-stage funding, say experts who spoke at the Science|Business Innovation Connection conference in Berlin on 7 October. So-called growth capital, which starts around €10 million and up, is vital to ramping up operations and expanding into new markets quickly.

Some of Europe’s venture capitalists are thriving, “but the question is whether there are enough and whether they have [sufficient] cash,” said Will Cardwell, senior lecturer on venture capital and entrepreneurship at Aalto University in Helsinki.

Cardwell, a former venture capitalist, says government support helps, but falls short of what is required to invest in machinery, marketing and other infrastructure that young firms need to grow and compete globally. Europe needs more venture capitalists willing to risk money on high-cost investments that don’t produce short-term yields, he told the conference.

A Science|Business Innovation Board study conducted by Aalto University plans to analyse the growth-capital gap across key technology sectors in Europe and explore the potential impact of that deficit on EU competitiveness. Results of the study, Growth Capital, The Missing Link in Europe’s Innovation System, will be released next spring.

For Anne Glover, chief executive of Amadeus Capital Partners, big institutional investors like pension and insurance funds could help Europe overcome the growth capital gap by investing in a “fund-of-funds,” that holds a portfolio of venture funds. But European institutional investors are focusing on maximising yields.“One of the problems of the financial crisis has been that private money has gone for yield and not capital return,” says Glover, chairman of the European Private Equity and Venture Capital Association (EVCA) and a co-founder of London-based Amadeus, which invests in early-stage technology companies. “I think it’s really important to understand that innovation, at its core, early on and during its birth phase, needs to financed by equity, needs to be financed by long-term, non-yielding instruments – and the value chain for equity has been broken.”

EU and national efforts to finance innovation and start-ups have helped increase the pool of young technology companies, but early-stage support “only gets companies so far,” she says. Meanwhile, pressure from regulators has discouraged European pension and insurance fund managers from backing investments that take longer to pay dividends.

That’s prompting Europe’s venture capital companies to seek money from sovereign wealth and foreign funds that are less risk-averse. But there’s a hitch: smaller VC firms often lack the means to attract big funds. “It’s the scale problem,” Glover says.

Foreign capital is not the only solution. Candace Johnson, president of the European Business Angels Network (EBAN), proposed the creation of “e-zones” or entrepreneurship zones across Europe that encourage innovation by reducing the barriers for start-ups and venture investors – much like free-trade zones encourage trade.

“It’s a mentality thing, it’s getting everybody to say that we’ve got to create European success stories, and we’ve got to get everybody on to that,” said Johnson, an angel investor and entrepreneur who founded the Luxembourg-based satellite company SES.

“It is ridiculous to talk about a German success story or a French success story. In America they say it’s an American success story. We need to have that same thing – cross border, barrier-less open space where you can create something big. And I’m certain we are able to do this.”

There are signs of investment growth. The value of venture capital investments in the EU rose 19 per cent in 2013 to $7.4 billion, according to a study by the accounting firm Ernst & Young. However, EU investment still falls far short of the $33.1 billion invested by US venture firms last year.

Determined to strengthen Europe’s innovation potential, the EU plans to pump €80 billion into research and development over the next seven years through the Horizon 2020 programme, now the EU’s third biggest expenditure after support for agriculture and rural development. Under pressure to create jobs and growth in 21st century industries, regional and municipal governments across the EU are devising innovation strategies and supporting entrepreneurs.

Besides addressing finance challenges, the Science|Business event honoured promising young spin-outs from research universities that have succeeded in bringing technologies to the market.

Along with Glover and Johnson, other participants on the panel, “Overcoming the funding crisis – new ways to finance innovation,” highlighted additional solutions and challenges.

Gunnar Muent, director of innovation and competitiveness for the European Investment Bank, said grants and other forms of public funding need to be combined more effectively with equity and debt. “At the moment is that there is no debt market that is willing to finance technology or innovation,” said Muent, urging the EU and national governments to be more flexible in providing grants that are less restrictive.

The rules on how grants can be used at start-ups “are far too complicated to apply to a normal finance situation,” he says, adding that “to get a lot more investment off the ground is a chicken-and-egg problem.

Mmboneni Muofhe, deputy director general for technological innovation at South Africa’s science and technology department, drew on his country’s experience in supporting new entrepreneurs to warn that lack of venture capital can squeeze companies out of the global market. He cited the example of a South African medical technology company’s inability to expand into to the United States despite its promising bone-regeneration technology because of its inability to raise capital. “You’ve got these good ideas that come and then they die,” he said. “We really have good ideas, good people, but they just don’t know where to go to get support.”

Adjusting investment patterns only slightly could free up significant capital, the panelists agreed. Amadeus Capital’s Glover estimates that venture capitalists raised some €4 billion last year compared to nearly €50 billion for private equity funds. Retirement funds are a promising source of long-term financing – PensionsEurope estimates its 23 national fund associations and similar workplace organisations represent €3.5 trillion of managed assets. “We only need a tweak on the edge of the system to help fund new ventures,” Glover said in an interview, when asked about the use of pension assets.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.