Innate Pharma SA, a Marseilles-based biopharma company, said it raised €30 million in an initial public offering and listing on Euronext Paris.

The successful flotation, at a price of €4.50 a share, was in the mid-range of its target of its €4.10 to €4.80 a share. The offering, which valued Innate Pharma at €108 million, was 2.5 times over-subscribed, the company said.

The company had initially announced plans to float in June, but then held off on the flotation - saying it was waiting until the market picked up before going ahead.

Innate is developing drugs that target the innate immune system. The main focus is on cancer, where its lead product IPH 1101 is in Phase II trials in renal cell carcinoma, but the technology is relevant to autoimmune and infectious diseases also.

The company has collaborations with a number of Inserm (Institut National de la Santé et de Recherche Médicale) laboratories in France and with the universities of Perugia and Genoa in Italy.

In addition, Innate is partnered with Novo Nordisk in the area of natural

killer cells. The Danish pharmaceutical company owns 20 per cent of Innate and

has said it will take part in the IPO. As expected, Novo Nordisk invested €5

million in a private placement, buying 1.1 million shares at the

IPO price.

The stock began trading on Wednesday 1 November.

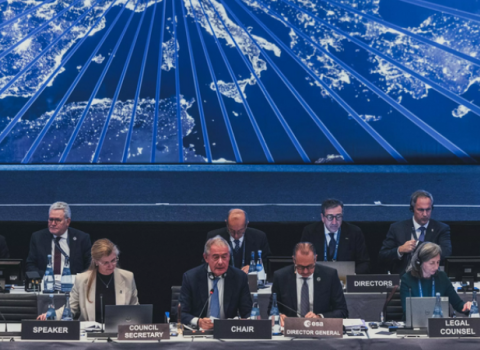

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.