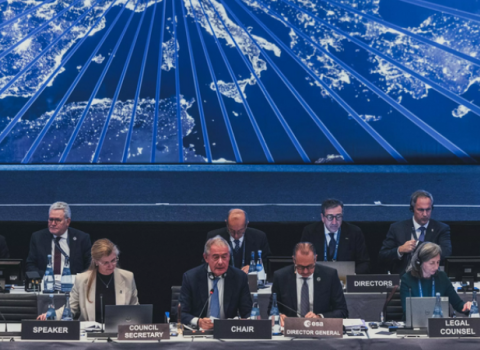

Stirring the pot: centre director Leon Sandler.

Sandler, who is executive director of MIT’s Deshpande Center for Technological Innovation, is a model of efficiency, working with a hired staff of only two. The rest of those involved in the centre are volunteers, including typically highly paid venture capitalists, business people and serial entrepreneurs, all there to act as catalysts to help along the newest promising ideas from MIT professors and students.

“We give grants to continue one or two years of research. We fund the proof of concept work such as to build a prototype,” Sandler said. “The big investment isn’t us; it’s the next person in the food chain. Once someone forms a company, our involvement stops.”

The next step might be a group like the Venture Mentoring Service at MIT, a service that brought Sandler to MIT in the first place. Sandler spent years in industry at large companies such as Digital Equipment Corp. and Eastman Kodak before creating his own consulting firm, which ended up consulting with many startups.

Translating ideas into products

The Deshpande Center sprung from the desire to help entrepreneurs translate their ideas into innovative companies and products. It was started in 2002 by a $20 million gift from MIT alumni Jaisree Deshpande and Desh Deshpande, the co-founder and chairman of Sycamore Networks Inc. The Deshpande Center is part of MIT’s School of Engineering.

Since its founding, the centre has funded 64 projects with more than $7 million in grants. Eleven of the projects have developed into independently funded companies, having raised a collective $88 million-plus in outside financing.

Each spring and fall the centre awards $50,000 Ignition Grants to fund proof-of-concept explorations, as well as Innovation Grants, which range from $50,000 to $250,000, to help MIT research teams assess and reduce the technical and market risks associated with their innovations.

Back to basics

The ideas are pre-business plan, explained Sandler. All that applicants for grants need to supply is information on who will buy the product or idea, what the application is and how the entrepreneur or scientist will build it. The centre provides funding to get a working prototype or proof of concept.

One example is Vertica Software, which received Deshpande funding to build a prototype database program. The company subsequently raised $23.5 million in financing from investors including Kleiner Perkins Caulfield & Byers and Bessemer Venture Partners.

But to get to that point, MIT computer science adjunct professor Mike Stonebraker and his colleagues had to build a prototype of their program, which arranges a database in columns rather than rows to significantly speed up data retrieval. “We funded him to build the prototype,” said Sandler.

Another example is Brontes Technologies, which has 3D imaging technology that lets dentists build digital models directly from a patient’s mouth. Deshpande supplied the funding to build the prototype system. Brontes received several rounds of venture capital before being bought in 2006 by 3M for $95 million.

Gap funding

“The Deshpande Center funds the gap,” Jeff Andrews, a partner at Atlas Venture, said at a recent International Business Forum conference on early stage investing held in Boston. “The Deshpande Center pulls together a virtual community of people: the entrepreneurs with ideas, serial entrepreneurs and venture capitalists. A lot of us, including me, volunteer a lot of time to help.” The centre also taps people from MIT’s Sloan School of Management.

With close to 10 companies started that have raised significant venture capital, the Deshpande model is one to be watched. “We’ve recommended to the Governor [of Massachusetts] that he replicate this,” said Andrews.

Outside the village

But will the model translate outside of MIT’s strong village infrastructure of entrepreneurs, investors and managers?

Sandler points to the Scottish Enterprise Proof of Concept Programme to commercialise Scottish university research. “We do things differently, but at the macro level we are the same,” Sandler said of the two organisations. “New Zealand is following a similar model.”

He recognises that not every country has the infrastructure of the Boston area or Silicon Valley, and must thus find ways to pull in the missing pieces. But there also are some mindsets that need to change. He pointed to some cultures that think it may be uncouth for professors to make money on the side, or that think professors with business aspirations aren’t serious about their academic careers. “You need to adopt a culture where failure and risk-taking and making money are all OK,” he said.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.