With a broader global downturn in start-up investment, the resilience and ‘ingrained frugality’ of central and eastern Europe could see the region prosper

Central and eastern Europe’s technology start-up scene can become “Nordic-like”, with companies having global reach and highly innovative products, according to Alexandru Agatinei, CEO of How to Web, a leading technology conference in Romania.

Agatinei is highly optimistic about the region’s budding start-up scene, despite having just co-authored a report on venture capital deals that pointed to a big drop off in funding in 2023 compared to 2022. The report, covering 19 countries in central, south and east Europe, shows investment fell by 57%, from €4.2 billion to just over €1.8 billion.

However, this was part of a much wider trend, with Europe-wide investment dropping off 45% in the same period. “It was a year of ambivalence,” Agatinei told Science|Business. He is not overly concerned, because the fall is seen as a reaction to an overvalued market in 2021. Rather, the €1.8 billion posted in 2023 should be viewed in the context of 2020, when VC investment in central and eastern Europe was just €388.3 million.

Agatinei is confident the entrenched innovation performance gap between east and west Europe is soon going to be closed. “We believe there’s a cycle coming to an end,” he said.

His belief is based on the region’s strong performance in artificial intelligence, and other recent success stories, such as Romanian unicorn UiPath, Croatian electric car manufacturer Rimac Automobili and Bulgaria’s first unicorn Payhawk, to name a few.

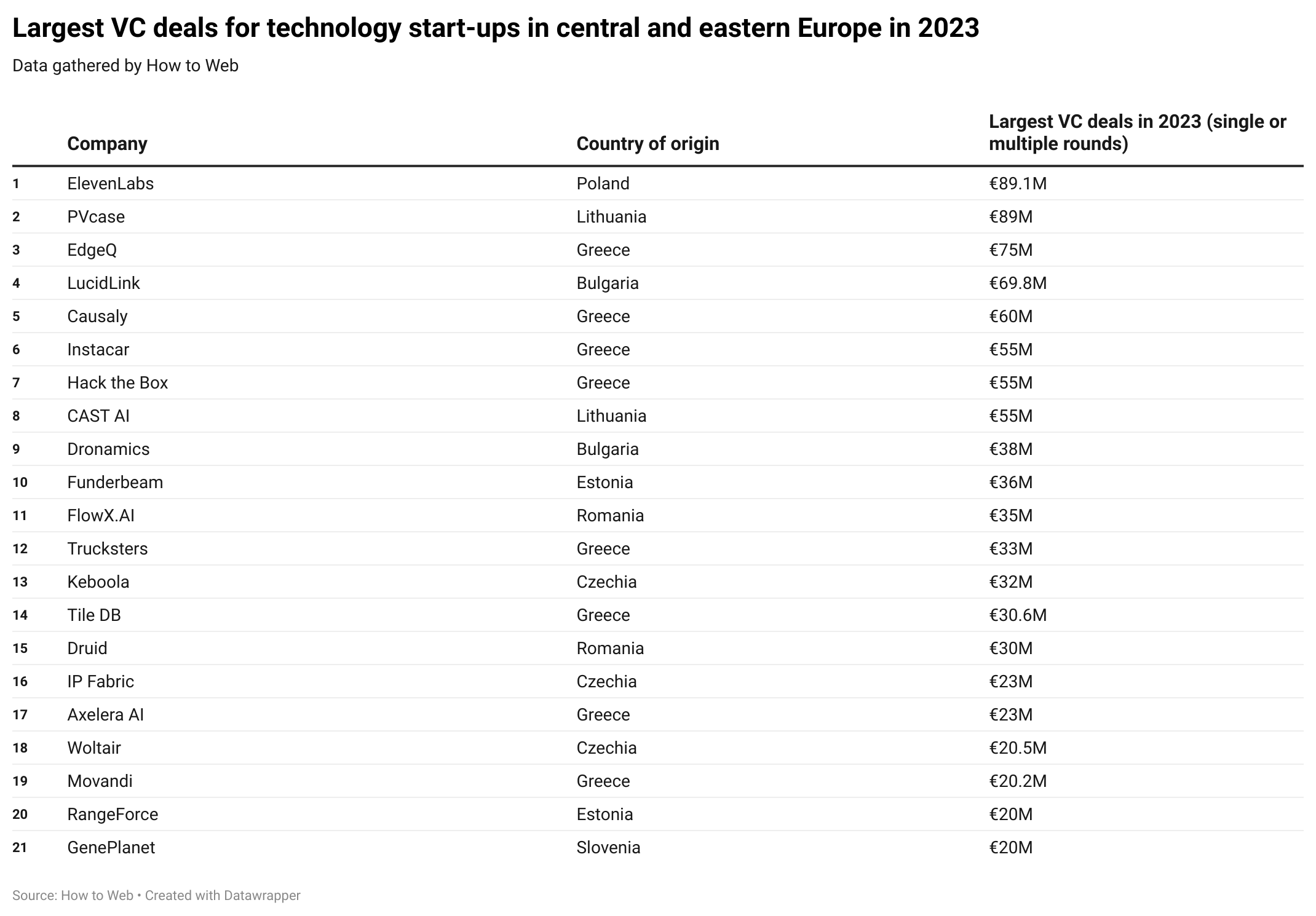

The region’s latest poster child is Poland’s ElevenLabs, which has achieved a €1 billion valuation and unicorn status within two years. The company raised €89.1 million over two rounds in 2023. Karol Lasota of Polish venture capital firm Inovo.vc called it the region’s “most significant event” of the year. “This achievement is a beacon of inspiration across the central and eastern European start-up landscape,” he said.

Agatinei agrees, saying this will increase confidence in the region. “[It] will further transform from a regional ecosystem to a Nordic-like set-up where products are highly innovative and companies built around them are global from day one.”

Sustainable growth

Start-up investment is less speculative than a couple of years ago. There are fewer big money risks being made and investors are falling less for hype and relying more on unit economics, with valuations based on its actual saleable products.

The trend in investment at the moment is more about finding companies committed to long-term, sustainable growth, rather than looking to make a quick exit. This change in sentiment and in the market in general plays to central and eastern Europe’s strengths, Agatinei says.

Start-ups in the region have “ingrained frugality” and have always been more likely to focus on steady growth. “We can attribute this behaviour partially to the efficiency embedded in our local DNA,” Agatinei said.

Lower costs in central and eastern European are also attracting VCs to invest in later rounds, at valuations that are lower than elsewhere. “It is possible that western investors investing in series A and B tickets might not have had sufficient deal flow and turned their attention to central and eastern Europe, where they could find a bit more stability, less inflated deals, and an impressive talent pool,” the How to Web report says.

A report by Intertrade Consulting, a business support and development agency specialising in central and eastern Europe, says foreign capital represents more than 75% of the money in later investment rounds.

While western investment into the region is positive, it is also a sign that local investors lack the capital to make larger investments. Judit Karsai, a researcher at the Hungarian Academy of Sciences who wrote a paper on VC investments in the region between 2016 and 2020, highlighted this as a problem. “The size of the venture capital funds in the region is far below the European average, so the start-ups only have a chance to become successful if they are involved in the international flow of venture capital,” she said.

A longstanding problem is the prominence of public money in start-up investment, which tends to err on the safer side and lacks the flexibility of private investment.

But Agatinei said, “While there is no shortcut to overnight success, the region’s momentum is stronger than ever with more success stories, more talent and more financing flowing into the region.”

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.