A greater proportion of capital is flowing to science and engineering-heavy firms. But tech companies say EU legislation is holding them back

This year’s State of European Tech report – a mammoth overview of the sector, now in its tenth year – is out, and is filled with insights for European innovators, some troubling, some encouraging, just as the new Commission in Brussels makes growth and technology independence priority number one.

Investment in 2024 has levelled off after two wild years in 2021 and 2022, when money was cheap.

But overall, the message is upbeat. Although still behind the US, Europe’s tech sector has transformed since 2015, when the first report was published. The tech industry workforce in Europe has grown sevenfold. The number of companies worth more than $1 billion has exploded. And over the past decade, an outflow of tech talent has turned into an inflow of tens of thousands, although Europe still sees a net loss of people to the US, Australia and Canada.

"Nobody would have believed this in the early 2000s,” says Taavet Hinrikus, co-founder of Wise, the London-headquartered money transfer company, quoted in the report. “If we think about it, Europe has a maybe 30 year lag to Silicon Valley. We can only think about where we're going to be in 10 years, 20 years from now; a lot more companies will get to the same state. We have all the ingredients for the trillion dollar companies to be born in Europe."

Here, Science|Business extracts five of the most important findings. In the following figures, it’s important to remember that the UK is included as part of Europe, and on some measures it is the continent’s strongest tech player, so European strengths might not quite be EU strengths.

Deep tech increasingly important

One key finding is that in Europe, investors are increasingly putting their money into so-called ‘deep tech’ - typically capital-intensive, science and engineering-heavy ventures that try to create new technology, be it robotics, artificial intelligence, or advanced materials. As such, it’s a part of the tech scene that’s particularly important to universities and researchers.

Deep tech stands in contrast to companies which might use existing technology to build a new payments system, or an online booking site, for example.

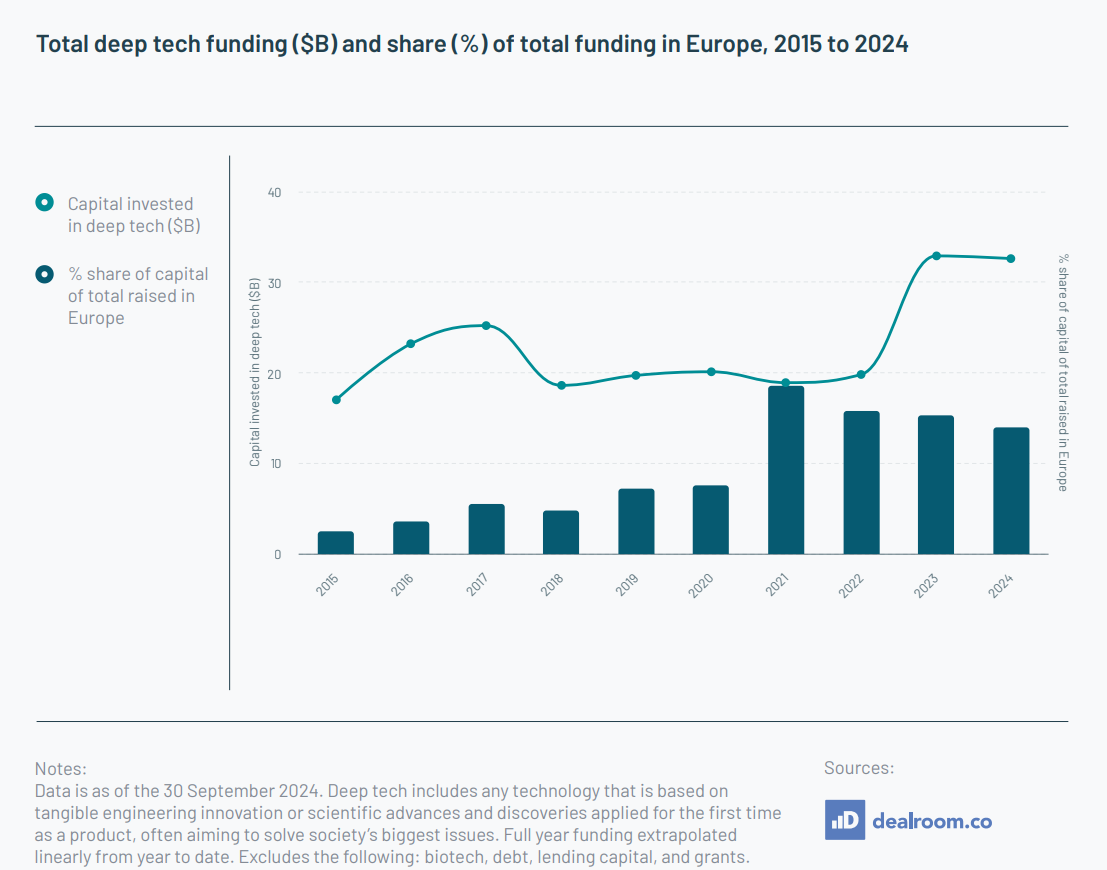

The report shows funding going to deep tech has hovered around 20% over the past decade, but shot up above 30% during the past two years.

“Europe’s deep tech ecosystem boasts a combination of research excellence, a strong talent pool from world-leading institutions, and success stories like Deepmind keeping the flywheel in motion,” the report says.

Behind the US, but overtaken Asia

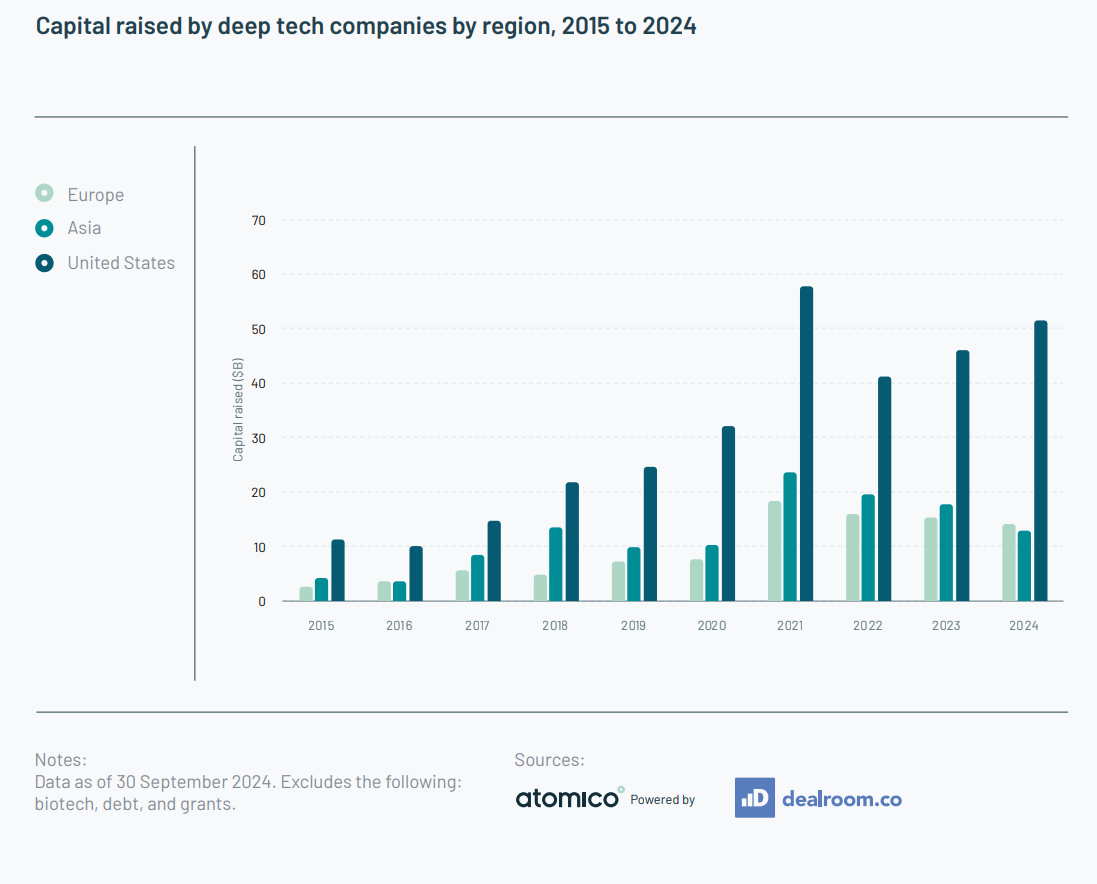

Despite the growing importance of deep tech, Europe still lags far behind the US when it comes to investment. This year to 30 September, US deep tech firms raised $52 billion, compared to just $14 billion in Europe, and $13 billion in Asia. The rise in deep tech investment in the US is largely driven by AI and machine learning, the report notes.

Of the world’s top ten best funded deep tech firms, eight are based in the US, with the list being led by OpenAI, self-driving car firm Waymo, SpaceX, and AI firm Anthropic. Sweden’s Northvolt is fifth on the list, but it’s currently struggling to fend off bankruptcy. The other European deep tech firm in the top ten is green steel firm Stegra, also based in Sweden, which has raised $2.4 billion.

But it’s not all bad news for Europe. The report shows that in 2024, for the first time the continent raised more capital for deep tech firms than Asia.

Europe overtakes China on AI funding

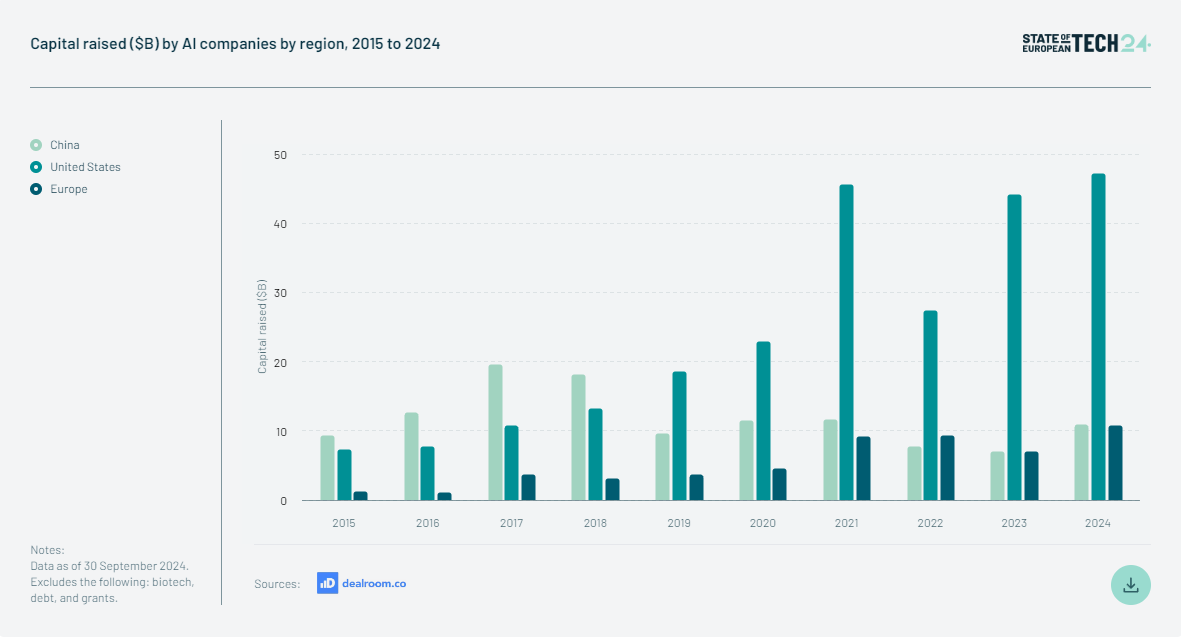

On AI funding, there’s a similar story. Europe still lags far behind the US, raising $11 billion to the US’s $47 billion in 2024.

But over the last decade, Europe has caught up with China, partly because the continent has raised more capital itself, and partly because Chinese investment has dropped off.

EU rules seen as a drag

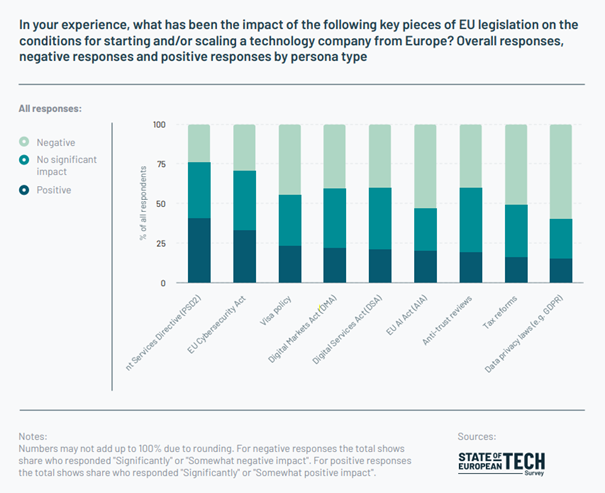

Respondents to a survey also generally thought new EU legislation, like the General Data Protection Regulation, the AI Act, the Digital Markets Act and the Digital Services Act made it harder to start and scale a company in Europe. This will bolster the case of returning Commission president Ursula von der Leyen, who has called on all new commissioners to cut back on red tape.

“The high levels of optimism seen over the past decade are being eroded, with challenges including the lack of progress on regulatory reforms, market harmonisation and greater access to funding cited by our respondents,” the report says.

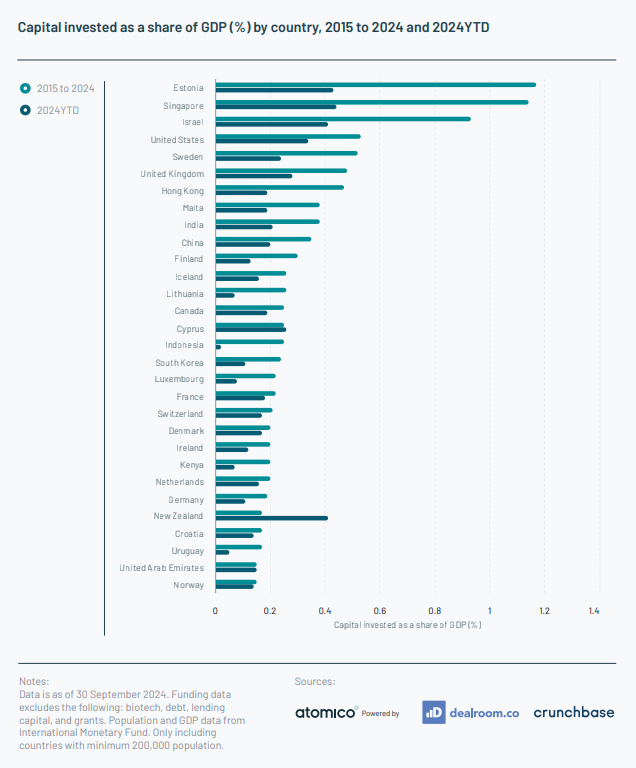

Estonia leads the VC world

Although the US still has the venture capital market Europe wants to emulate, accounting for the size of its economy, Estonia actually attracts more venture capital funding, according to a ranking of VC funding as a share of GDP.

Of the top 30 countries globally, 17 are from Europe. But, the report notes, some big European nations are far down the list, including Spain at 34th and Italy at 60th, “behind a number of developing countries.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.