The US is now supremely dominant in terms of private investment and compute capacity. But Chinese open models are leading the way

Photo credits: A Chosen Soul / Unsplash

EU policymakers are desperate for the bloc to create and use AI models, perceiving that the continent has fallen behind the US and China, and last week launching twin strategies to boost adoption of the technology and spur its use in science.

This impression that the bloc is lagging behind appears to be largely true, according to the State of AI Report 2025, a major annual analysis of the industry by Air Street Capital, a venture capital firm.

The US now utterly dominates private investment and AI supercomputing, according to the latest statistics, while China is now the leader in open AI models.

However, a drop-off in Chinese private investment in AI means the EU has overtaken it. Meanwhile, fundamental, public research in AI appears to be neglected, according to the report.

AI, of course, can mean many different things, from computer vision to natural language processing, but over the past three years it has become largely synonymous with the breakthrough large language models (LLMs) that power chatbots like ChatGPT.

European policymakers reading the financial press may increasingly wonder whether going all-in on LLMs is a wise move. The investment boom in the US is now widely deemed a bubble and the biggest private AI companies, including OpenAI and Anthropic, continue to lose money, with their path to profitability unclear.

Still, The State of AI report is generally bullish about business adoption of AI, and the continued improvement of leading LLMs. Large labs and leading AI companies are generating $20 billion in annual revenue, it found.

But it does acknowledge that US tech giants seeking to lead the AI field “increasingly use exotic financial structures” to raise money. “This financial sleight of hand works to conceal the mountains of debt accumulation within the AI sector,” it says.

Here, Science|Business picks out the five top trends and charts relevant to Europe.

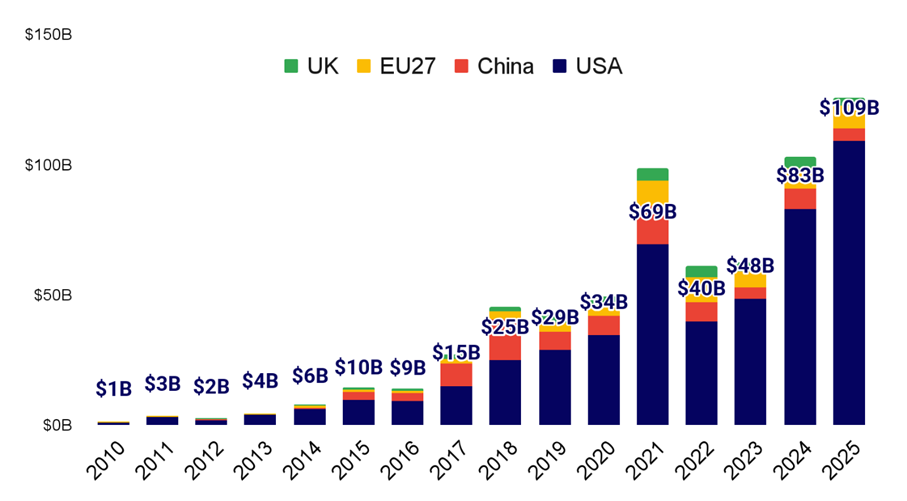

- The EU invests more private money in AI than China, but still trails the US by a huge margin

Caption: private investment in AI, by country/region.

Source: the State of AI Report 2025, Air Street Capital

The US and China are often spoken about as the world’s leading AI rivals, and that’s largely true, based on performance benchmarks of the most powerful LLMs, with France’s Mistral also offering a competitive alternative.

However, in terms of private investment, the US is now the only game in town.

This year, $109 billion of private investment flowed to US AI firms, an astonishing 81% of the global total. That marks a change from the late 2010s, when although the US still attracted more investment, China was often competitive.

Since then, however, Chinese private investment in AI has withered, from a high of $16 billion in 2018 to just $5 billion so far this year.

This has allowed the EU to become the second biggest global magnet for private AI investment, attracting $8 billion so far this year.

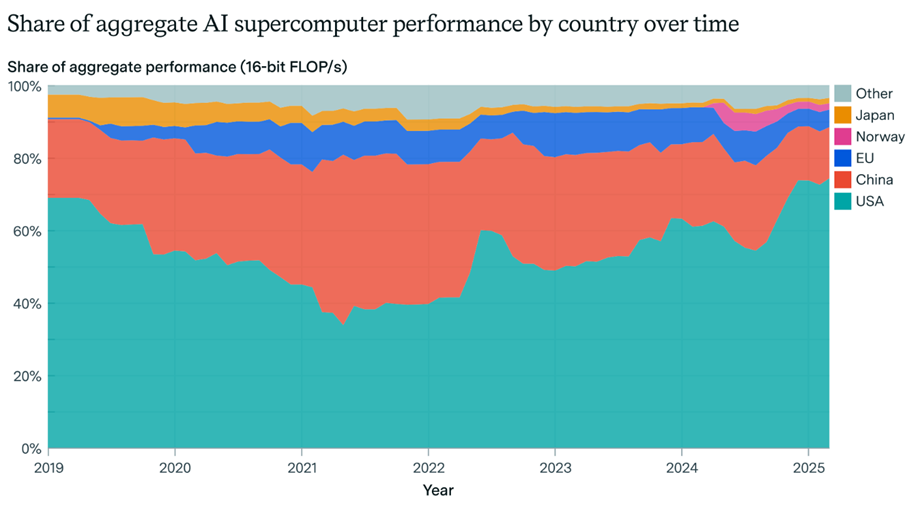

- The US also increasingly dominates AI computing capacity

Source: Trends in AI Supercomputers

A similar trend is playing out in access to AI supercomputing, the report finds, with the US now more dominant than ever, and the EU’s share squeezed to a small fraction of global capacity.

The US has nine times China’s capacity, and 17 times the EU’s, the report says. “This creates a self-reinforcing cycle where compute advantage drives breakthroughs that attract more investment,” it says.

The EU has pledged €20 billion to help build so-called gigafactories, massive clusters of AI-focused chips, although some are sceptical about the viability of this plan.

Another trend in AI computing capacity is a shift from public to private. In 2019, public bodies such as universities controlled 60% of the compute capacity, but that has now fallen below 20% as privately controlled projects have proliferated.

This shift towards private supercomputers “limits academic compute access and reduces government visibility into AI development, as companies can afford $7 billion systems while government projects max out at $600 million, creating both a research bottleneck and a policy blindspot,” the report says.

On current trends, by 2030 the leading AI supercomputer will cost an astonishing $200 billion, contain two million chips, and require the equivalent of nine nuclear reactors to power it, the report says, “making power grid capacity rather than chips or capital the likely binding constraint.” Local protests against data centres in the US may also slow building, it says.

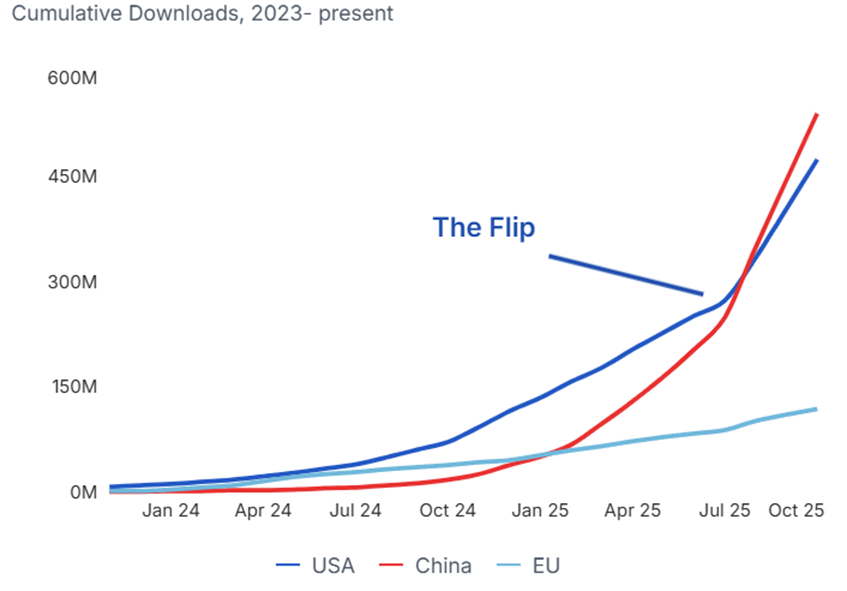

- The EU is losing the open model contest

Source: the ATOM project, Hugging Face

One big debate within the LLM ecosystem is whether providers should make their models open for others to download and modify. While the top US models are generally closed, some in the US and Europe want open models, partly so that start-ups have more freedom to adapt these models into useful products.

However, despite lagging the US on private investment and supercomputing capacity, Chinese open models, especially Qwen, developed by Alibaba, have become the world’s go-to open LLMs. Mistral, which had a surge of popularity in 2024, has now been eclipsed.

“After years of trailing the US in model quality prior to 2023, Chinese models - and Qwen in particular - have surged ahead as measured by user preference, global downloads and model adoption,” the report says. It has now outstripped Meta’s Llama model too.

China’s lead “isn’t because the West gave up. Chinese models got a lot smarter and come in all shapes and sizes - great for builders!” the report adds.

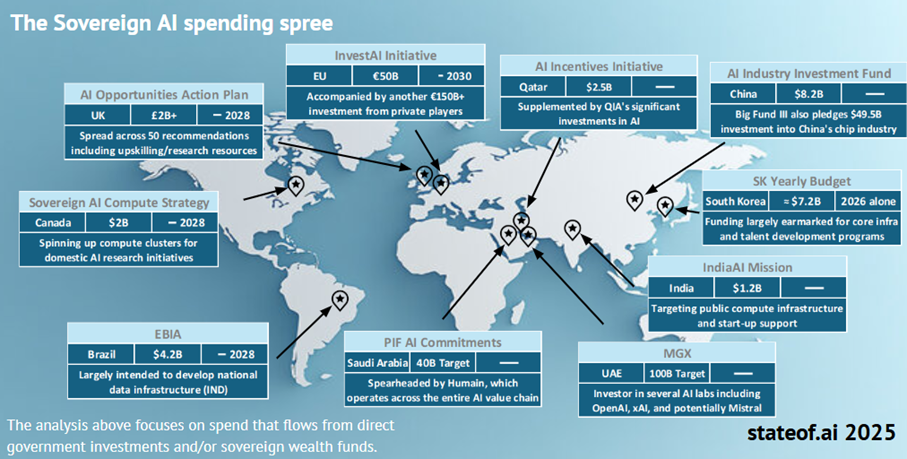

- States across the world are spending big on “sovereign AI”

Source: the State of AI report 2025

It’s not just the EU that is spending lots of money in order to avoid becoming dependent on US or Chinese models, the report says.

The past year has seen an upsurge in “sovereign AI” projects, as countries from South Korea to Saudi Arabia hope to “control their own destiny” when it comes to the technology.

These initiatives differ widely. Some are entirely from private investment, like France’s €109 billion announcement made in February. States in the Gulf, meanwhile, are using the sovereign wealth funds to back AI projects.

“Some nations hope to develop fine-tuned models that preserve their language and culture, other nations attempt to spin up national compute clusters, and some even attempt to upskill huge swaths of their populations,” the report says.

But the report also warns about “sovereignty washing,” noting that “without support for indigenous capabilities, sovereign AI projects can deepen a nation’s dependence on foreign supply chains.”

The report also notes that Jensen Huang, the chief executive of NVIDIA, the US-based leading manufacturer of AI-focused chips, has become a sovereign AI “evangelist,” touring the world to convince countries to buy its chips in the name of independence. “Sovereign AI remains one of NVIDIA’s strongest new demand drivers,” the report says.

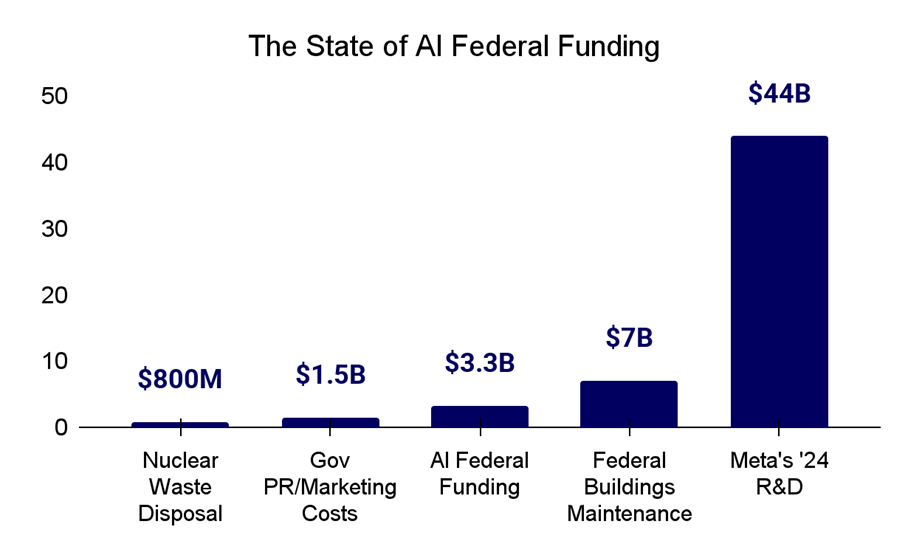

- Basic research in AI is being neglected

Source: the State of AI Report 2025, Air Street Capital

Despite the gargantuan amounts of private money sloshing around in the AI industry, publicly-funded basic research into the technology is miniscule by comparison and stagnating, at least in the US, the report says.

In 2021, a commission on AI led by former Google chief executive Eric Schmidt recommended boosting US federal AI research spending to $32 billion a year, a figure that was later endorsed by lawmakers.

Related articles

- European Commission cancels €45M Horizon Europe call for generative AI projects

- EU launches AI strategies to boost competitiveness and science

But the US has come nowhere near to meeting this target, the report says, with federal non-military AI R&D spending hovering around $3 billion a year since 2023. “It is unclear if foundational AI research will increase,” the report says.

“This is foundational, non-commercial research - the type of research that is sometimes argued to be more transformative than that of the private sector,” it adds.

The EU, by contrast, has launched €700 million worth of generative AI research funding calls through its GenAI4EU programme. But it’s unclear how much the bloc spends in total, as national governments remain the biggest source of research cash.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.