INSEAD, the leading international business school, today announced that its Global Private Equity Initiative (GPEI) has earned the financial commitment of an elite group of world-class companies. Abraaj Capital, General Atlantic, The Boston Consulting Group and PricewaterhouseCoopers are making significant financial contributions to further advance an initiative that INSEAD launched in 2009 and has continuously enhanced since.

The INSEAD GPEI combines the expertise of INSEAD’s robust private equity teaching and research with the school’s alumni and other global professionals working in the private equity environment.

“Since inception, Abraaj Capital has been an early advocate in promoting transparency for the private equity industry and partnered with a diverse range of stakeholders in achieving that goal. INSEAD’S Global Private Equity Initiative is playing a unique role in delivering original research and insight to General Partners and Limited Partners alike on the industry. As founding members of this initiative, we are proud to extend our tradition of facilitating ideas, networks and best practice within the sectors and global markets in which we invest”, comments Frederic Sicre, Partner and Head of the Abraaj Sustainability and Stakeholder Engagement Track (ASSET).

The INSEAD GPEI distinguishes itself by taking a truly internationally balanced approach that covers private equity activity in both developed and emerging countries. The initiative provides an independent platform for limited partners (LPs), general partners (GPs) and other stakeholders to exchange ideas. The INSEAD effort is backed by a strong partnership with carefully selected top global institutions, which provides the practitioner expertise that complements INSEAD’s rigorous PE scholarship. In addition, the GPEI will work closely with leading data providers to the private equity industry Asian Venture Capital Journal, Dow Jones and Preqin in its research activities.

“INSEAD is delighted to welcome these great global firms,” said Claudia Zeisberger, Affiliate Professor of Entrepreneurship and Family Enterprises and GPEI Academic Director. “Their support is a strong endorsement of our efforts to extend the boundaries of private equity research while creating greater dialogue between PE researchers and practitioners. We look forward to growing this core supporter group in the coming months as we build on our one-of-a-kind platform.”

The support of these partners will bolster GPEI’s research development and enable expansion into new regions and highly relevant topic areas—including emerging markets. INSEAD brings to the initiative a longstanding reputation as a global management school whose multiple campuses offer unique advantages, as does INSEAD’s practitioner-oriented approach to research, which ensures that the school’s thought leaders produce insights with real impact. Equally crucial is INSEAD’s unbiased approach to research, which permits penetrating analyses and stimulating exchanges.

“These world-class partner companies all recognise the importance of independent research and outreach activities for the growth of the global private equity industry,” said Michael Prahl, GPEI Centre Director. “Their multi-year commitment allows INSEAD to build on the Centre’s foundational work while enabling us to dedicate equal focus on developed and emerging markets. In addition, this support helps us meet the needs of LPs and GPS, as well as an extended network of stakeholders within the private equity industry.”

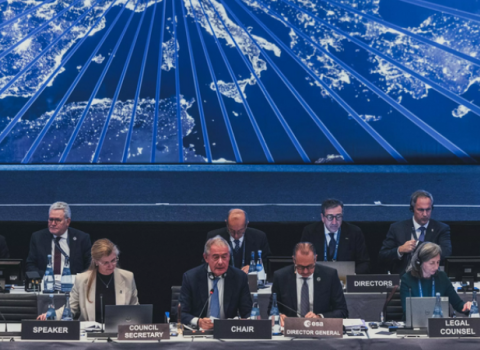

The new corporate support came in advance of INSEAD’s 4th annual Asian Private Equity Conference, which occurred in Singapore on 9 November 2012. The marquee event is organised by MBA students in the INSEAD Private Equity Club (IPEC) and serves as a world-class forum for practitioners and scholars to come together to advance dialogue on a range of issues related to global private equity.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.