The EU needs to close the investment gap for quantum start-ups and make procurement a lever for work for European competitiveness

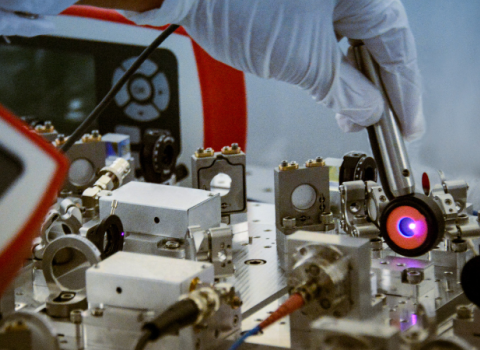

Jan Goetz, chief executive and co-founder of IQM Quantum Computers (on the left), and Milja Kalliosaari, government relations manager at IQM Quantum Computers (on the right)

Europe's quantum start-ups face a critical funding gap, with too few large investors to support growth. With the window closing fast, Europe must act quickly to capitalise on its strengths and lead in quantum technology, or risk falling behind in the new geopolitical landscape.

The global quantum computing market is projected to expand from €848 million in 2023 to €100 billion by 2040, underscoring the immense economic potential at stake.

Europe's strong innovation ecosystem, skilled workforce and strategic location position it for global tech leadership. This can drive job creation, economic growth and higher-paying employment opportunities, ultimately fuelling the bloc’s overall development.

However, Europe faces a shortage of growth-stage funding for deep-tech companies, with a €375 billion shortfall compared to the US, as highlighted in the EuroStack report.

This report also notes that €75 billion of this gap is currently filled by foreign capital, highlighting Europe's reliance on external resources. Similarly, the 2025 European Deep Tech Report shows that 50% of growth capital still comes from investors outside Europe, underscoring the need for stronger late-stage venture capital availability in the region.

This is not to say that Europe is lagging behind completely. Quantum computing is a good example of the EU activating capital in a more strategic manner than in other critical technologies.

It starts with talent creation and fundamental research. Europe is extending its Quantum Flagship and several other initiatives, such as European Research Council grants and the Quantera programme, and streamlining Horizon Europe research grants. These initiatives are supported by quantum collaborative research programmes in the different EU member states that fund.

There are even bi-and tri-lateral programmes, such as the French-Dutch-German collaboration in quantum technologies. Such activities provide attractive non-dilutive funding for start-ups, they foster collaboration and ecosystem building, and they ensure a constant flow of talent due to the inclusion of universities.

But the European companies bolstered by the Quantum Flagship are now arriving at a critical growth phase, where they need to scale up. And this is where Europe falls short.

One way to fill the growth capital gap in Europe´s venture capital landscape is to mandate the European Innovation Council to make follow-on investments above €15 million in companies it has supported early on. This support for scale-up rounds is crucial for Europe´s deep-tech start-ups.

Related articles

- G7 leaders set out new AI and quantum research agenda

- Europe’s quantum tech companies need more users, say funding experts

More also needs to be done in Europe to build a more robust private investment ecosystem and foster industry deployment of quantum computing. In the US, companies such as IBM, Google, AWS, Microsoft, Honeywell and others invest heavily in quantum computing. In some cases, US start-ups in this area have been able to raise hundreds of millions of dollars from large corporations.

Finally, Europe must shift from a research-focused approach to one that fosters innovation and competitiveness. This can be achieved by scaling common EU-wide procurement procedures, such as the European High Performance Computing Joint Undertaking, and streamlining public tender processes, allowing start-ups and SMEs to compete on a level playing field. Consideration should also be given to how industrial adaptation can be supported in EU procurement and joint infrastructure projects. By leveraging public procurement, Europe can scale up its start-ups and SMEs, making them more competitive globally and driving economic growth.

Jan Goetz is chief executive and co-founder of IQM Quantum Computers. Milja Kalliosaari is government relations manager at IQM Quantum Computers.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.

A unique international forum for public research organisations and companies to connect their external engagement with strategic interests around their R&D system.